Calculate depreciation of house

How to Calculate Straight Line Depreciation. You can calculate this percentage in one of two ways.

Depreciation Of Building Definition Examples How To Calculate

The straight line calculation steps are.

. The FHFA has a house price calculator to estimate home values. Calculating depreciation all starts with the propertys Replacement Cost Value RCV and its estimated life expectancy. Note that the calculator does NOT project the actual value of any particular house.

In our example Marks asset was ready for service in. For instance if a buyer is selling a property after 10. Measure the size of your home office and measure the overall size of your home.

The depreciated value of the property is 1060 ie. Step 4 Determine the Depreciation Amount The depreciation amount equates to 3636 of the adjusted basis depreciated each year. The RCV is the current price of repairing or replacing.

16 Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. The straight line method is a depreciation of property in which equal amounts of depreciation expense are recognized each year during an assets useful life. Number of years after construction Total useful age of the building 2060 13 This is the remaining.

Subtract the estimated salvage value of the asset from. Step 4 Multiply your adjusted basis by your business-use percentage. Determine the cost of the asset.

Percentage of square feet. To calculate depreciation the value of the building is divided by 275 years. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

The result from this calculation is your adjusted basis. To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. The result is your basis for depreciation.

Where A is the value of the home after n years P is the purchase amount R is the annual percentage. The resulting depreciation expense is deducted from the pre-tax net income generated by the property. The home appreciation calculator uses the following basic formula.

Total Depreciation - The total amount of depreciation based upon the difference. Your basis in your property the recovery period and the depreciation method used in real estate. So now as per the above formula the depreciated value of the property is 1060 ie.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. In such cases depreciation is arrived at through the following formula. So in this method.

Step 5 Download the. Instead it projects what a given house. A P 1 R100 n.

Real Estate Depreciation Meaning Examples Calculations

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

Depreciation Schedule Formula And Calculator

Appreciation Depreciation Calculator Salecalc Com

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

Depreciation Formula Calculate Depreciation Expense

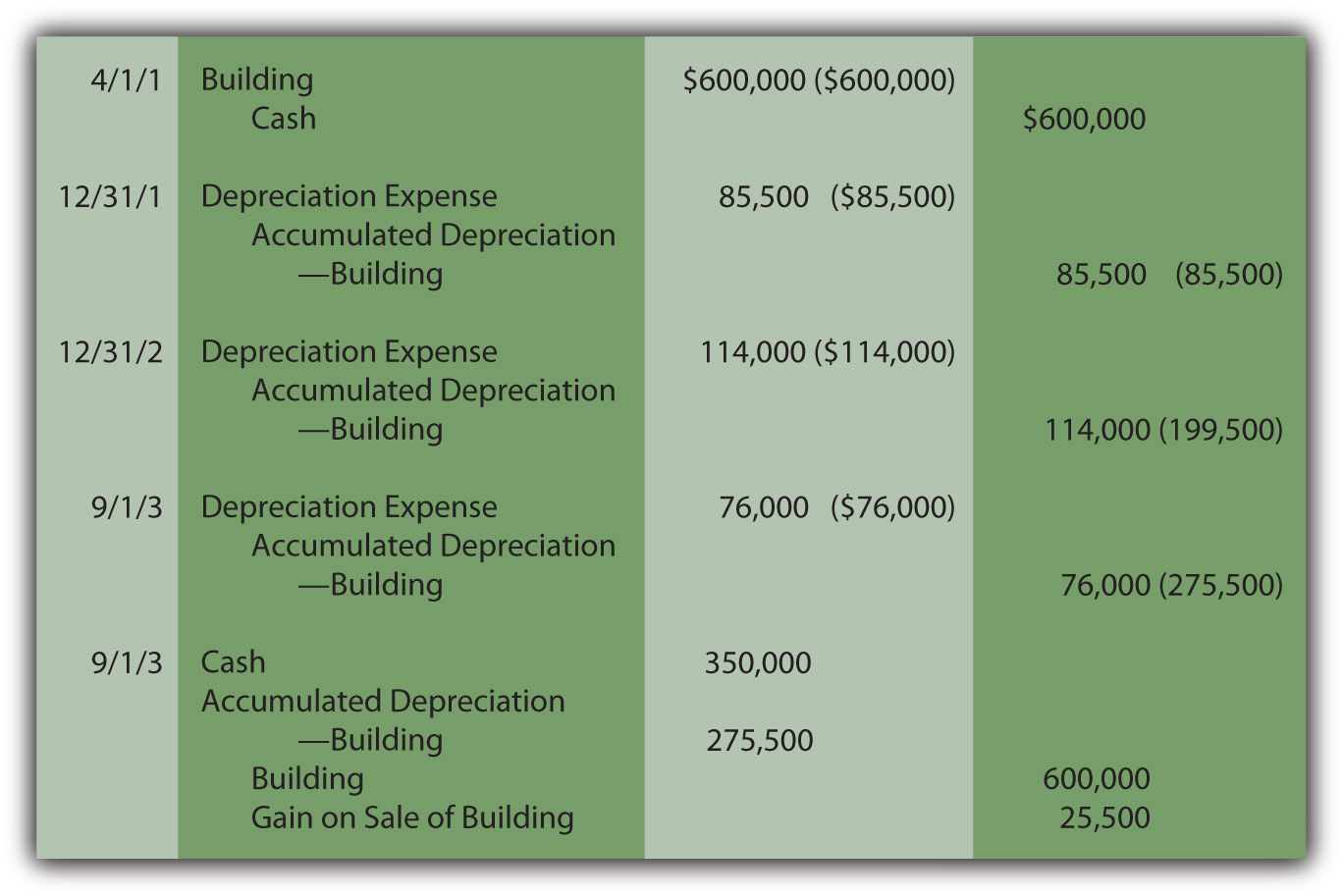

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

How To Calculate Property Depreciation

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Calculate Depreciation On A Rental Property

Depreciation Schedule Formula And Calculator

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

How To Calculate Depreciation Expense For Business